| Donor Advised Funds (DAFs), which first emerged in the United States, have recently become attractive in Asia. According to the 2021 World Ultra Wealth Report, the second largest number of ultra-high net worth individuals (UHNWIs) live in Asia. Also, the report indicates that those who became UNHWIs are interested in philanthropy, and this interest seems to be greater as they are inherited more. However, even though the donation amount is large, the amount that can receive tax benefits is limited. Since the tax policy and the limitations differ from country to country, the New York Community Trust of the United States first launched DAFs to ease the limit of tax deductions for those who are interested in donating as much as they want. |

Donor Advised Funds (DAFs)

- It refers to a donation when a donor finalizes his/her intention to donate and makes a donation to the Donor Advice Funds account, the financial company takes over the management and delivers the profits to the recipients or the non-profit organizations. Donors can provide continuous advice on the operation and distribution of donated assets, so they can expect the same effect as establishing and operating a foundation.

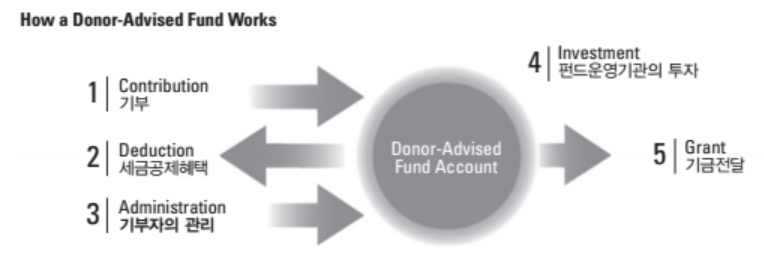

- The donation process is as follows, and for more details of each process, see [Planned Research 2014-5] Corporations, Trusts, and Donor Advice Fund (written in Korean).

Source: [Planned Research 2014-5] Corporations, Trusts, and Donor Advice Fund

Source: [Planned Research 2014-5] Corporations, Trusts, and Donor Advice Fund

- Contribution(Donation) -> Tax Deduction -> Administration -> Investment of the Financial Company -> Deliver the Grant

Donor Advised Funds in Korea

- It was developed as a financial product by Shinhan Investment Corp. in April, 2012, to revitalize Korea’s large-scale donations, but it did not make a great result due to small funding. To just take a look at the form of a financial product, there is no difference from the DAFs in the United States, but it is different that it is only available to set up a fund in a for-profit company engaged in financial investment business or a specific non-profit organization where is capable of conducting financial investment business. There is a need to focus on broadening donor options.

- In addition to the above financial product, the four major banks are operating donation trusts. Kookmin Bank: Great Heritage Donation Trust, Shinhan Bank: Life Care Donation Trust, Hana Bank: Living Trust, Woori Bank: Naerisarang Trust Service.

- There is also a Korean version of DAFs, using all the donation up in certain amount of time. The Community Chest of Korea has created an ‘honor society’ and directly manages the fund while carrying out support projects at the same time. The donor who becomes a member of the ‘honor society’, decides the name of the fund and manages it, and can advise on which social issues to support.

- The first one: Kim Bong-Jin, CEO of Woowa Brothers. The second one: Kim Jimahn, CEO of Jecumen Investment

See also:

기부자조언기금(Donor Advised Funds, DAFs)_Kor.

[Planned Research 2014-5] Corporations, Trusts, and Donor Advice Fund_Kor.